So, you just got rejected from a scholarship… 🤘😔🤘Highkey the worst feeling in the world. But this is not the end, y’all! Far from it!

I totally get it – you’ve put in hours perfecting your application, crafting essays, meeting deadlines… all for a big ole “no.”

It’s okay to take some time to process your disappointment. The most important thing is to not give up! Ya girl Jane is here with some steps to get you back on the scholarship train.

1. Remember, Rejection is Part of the Process

We all know that scholarships are highly competitive, but it doesn’t mean you aren’t deserving. There are a lot of students competing for the same awards, and sometimes it just comes down to numbers, or other factors out of your control.

But this doesn’t mean your application wasn’t good! Usually, a scholarship rejection just means that this particular opportunity wasn’t the right fit.

Each rejection is part of the journey to finding the scholarship meant for YOU.

2. Reflect, Don’t Dwell

Trust me, it’s easy to focus on the disappointment. But this is actually a great opportunity for reflection! After you finish that giant tub of consolatory chocolate ice cream, try channeling your negative feelings into something productive.

Let’s plan any necessary tweaks to your strategy. Ask yourself a few constructive questions:

-

Did I meet all the criteria?

-

Could I improve my essay or interview skills?

-

Could I apply to more scholarships that match my unique strengths?

Use this to fuel positive change in your approach, and be sure not to dwell (for too long, at least…) on what didn’t go right. This is the time to get determined, besties!

3. Seek Feedback (When Possible)

Believe it or not, some scholarship providers are open to giving feedback on applications. It sounds scary, but what do you have to lose?

If you’re comfortable, you might consider reaching out to ask if they can share any insights on your submission. Feedback is valuable – what you learn could help you make a stronger application next time.

And even if feedback isn’t available, the practice of asking shows your commitment to improvement. Maybe they’ll remember you took this initiative next time around!

Plus, scholarship providers aren’t your only resource for feedback. Ask your parents, teachers, and/or other advisors – anyone who might be able to lend a fresh perspective on your application.

4. Reframe Rejection as a Stepping Stone

Think of each scholarship rejection as one step closer to success. Many successful scholarship recipients faced numerous rejections before landing their awards… like me.

It’s all about reframing setbacks as part of your growth. With each application, you’re building resilience, gaining experience, and increasing your chances of a future win.

5. Broaden Your Search

If you’re only applying to a small pool of highly competitive scholarships, it might be time to cast a wider net. Many students focus only on big-name national scholarships, but these often attract thousands of students.

Instead, try branching out! For example, local scholarships often have fewer applicants, which means less competition… AKA, a better shot at winning!

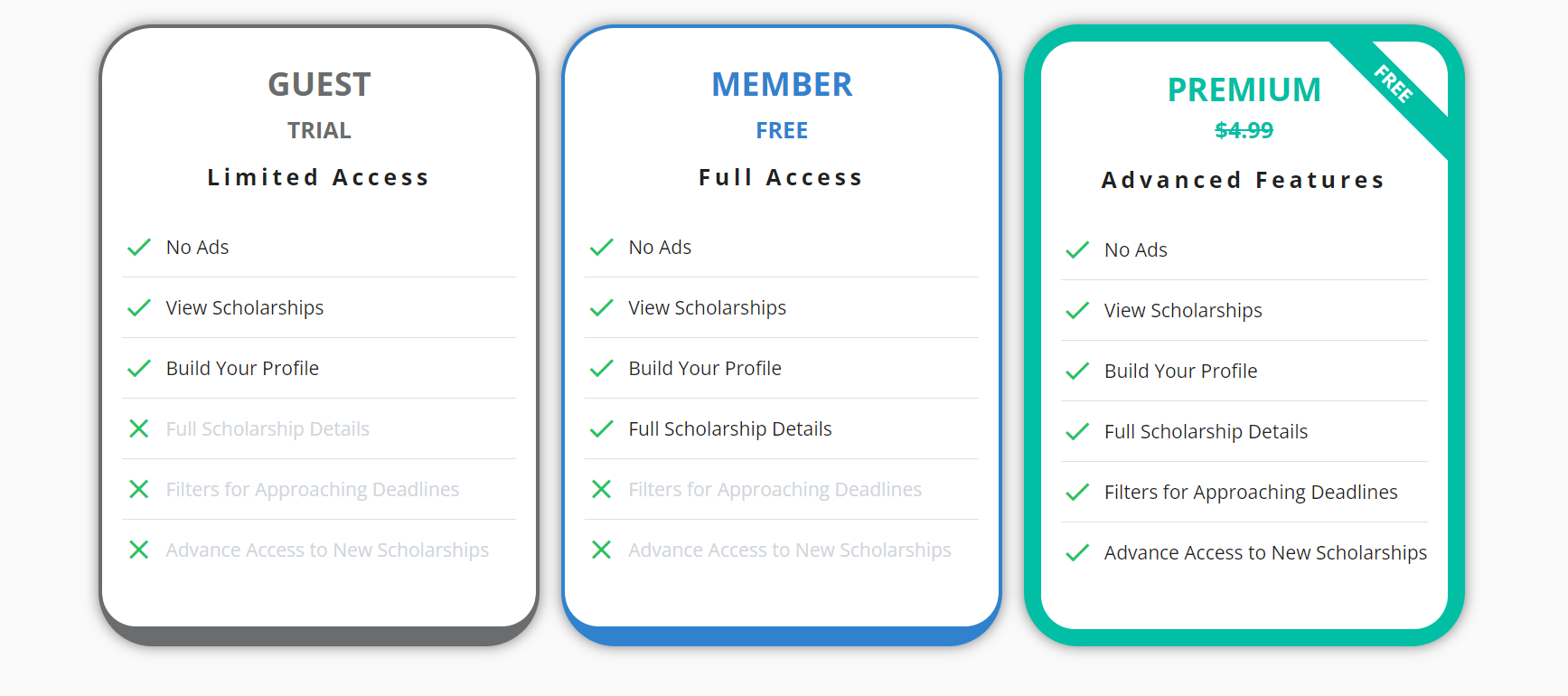

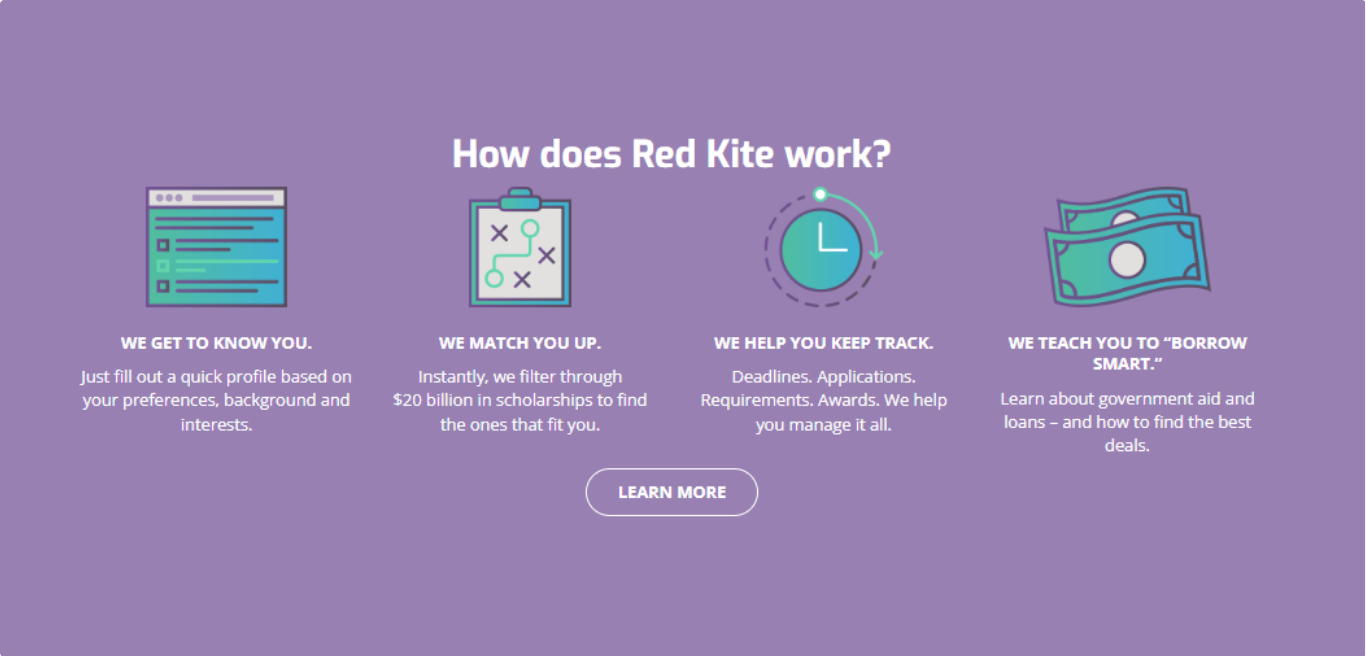

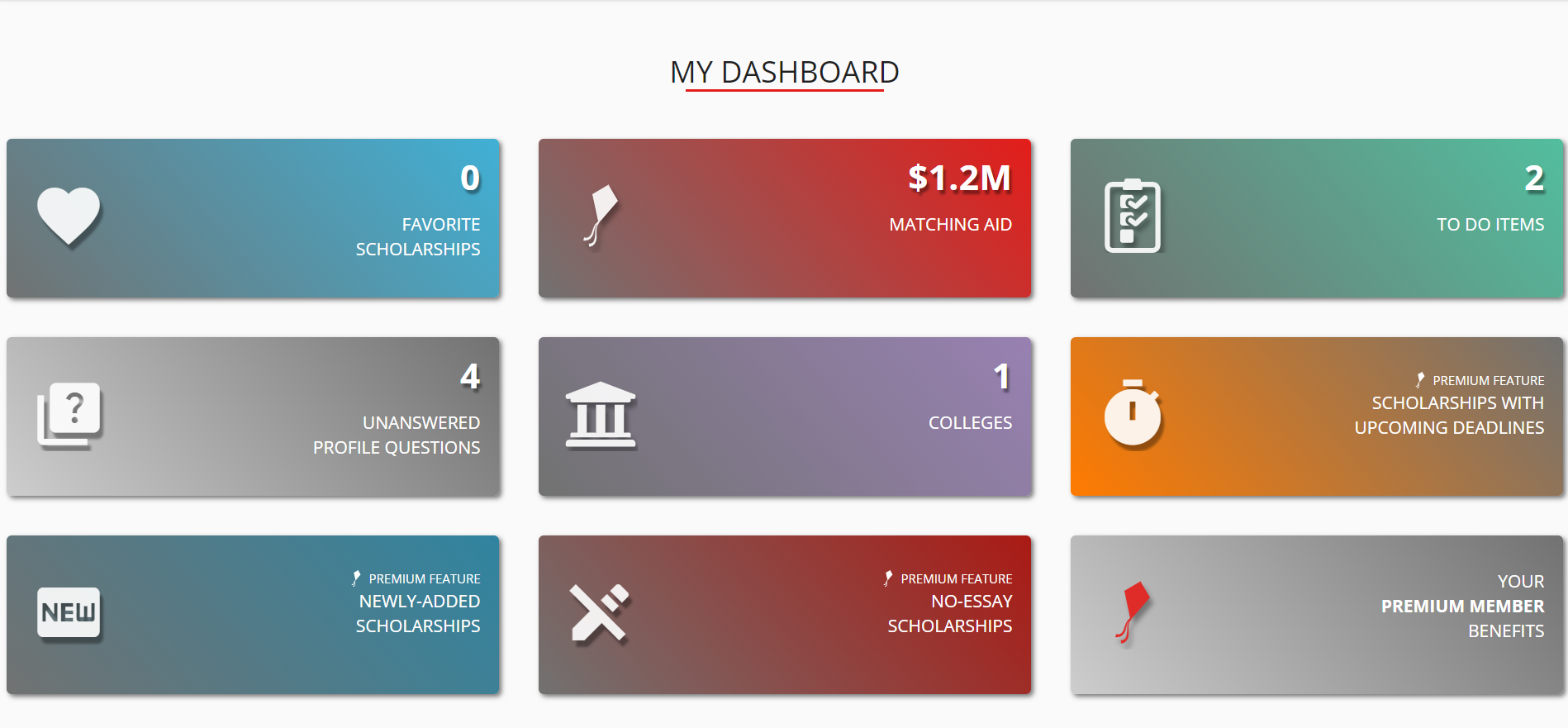

Also, Red Kite can connect you with hundreds of scholarships tailored to your own personal interests. Our platform offers over $25 billion in scholarships, grants, and loans!

It’s like having a personal scholarship matchmaker, introducing you to opportunities you may not even know exist. So don’t limit yourself – sometimes the perfect scholarship is one you haven’t even heard of yet.

6. Celebrate Your Effort

Applying for scholarships is an achievement in itself! Not everyone puts in the work to find and apply for financial aid opportunities, but you’re showing dedication to your education and future.

Maybe I sound like a broken record, but every application really does represent growth and commitment. So take a moment to celebrate your effort, regardless of the outcome. Get some Chipotle or take a long, hot bubble bath… you deserve it!

7. Keep Applying – Your Next “Yes” is Out There!

Scholarship rejections are only the end of the road if you decide that. The key to success is to never give up, no matter what!

Keep applying, learning, and refining your approach. With persistence, you’ll find scholarships that recognize your potential.

Hundreds of millions of dollars worth of scholarship money goes unused every year, so trust me when I say that there’s plenty for you out there. You just have to find your place in the spotlight!

Each application brings you one step closer to that “yes” you’ve been waiting for.

Rejection isn’t easy, but it doesn’t define your worth or your future.

Keep pushing forward, and remember: it’s all worth it in the end. Just think: you’re so close to reducing your debt and creating a more stress-free college experience for yourself!

You have what it takes to achieve your academic dreams, and your scholarship success story is still waiting to unfold.

You know what I always say, team: believe in yourself. It’s the #1 rule to life, especially when it comes to scholarships!

Be sure to sign up for Red Kite today!