The FAFSA is officially off your to-do list. Now let’s talk about what comes next.

For many parents, this is when the real questions start. Once your FAFSA is processed, the colleges your student applied to will begin sending financial aid offers. These letters can feel confusing or intimidating with all the numbers, terms, and fine print. But learning how to read them clearly can make a big difference in how you plan and pay for the upcoming year.

Step 1: Understanding Your Financial Aid Offer

Each school uses your FAFSA information to create a customized financial aid offer (often called an “award letter”). This offer outlines the estimated cost of attending that college and what types of aid your student qualifies for.

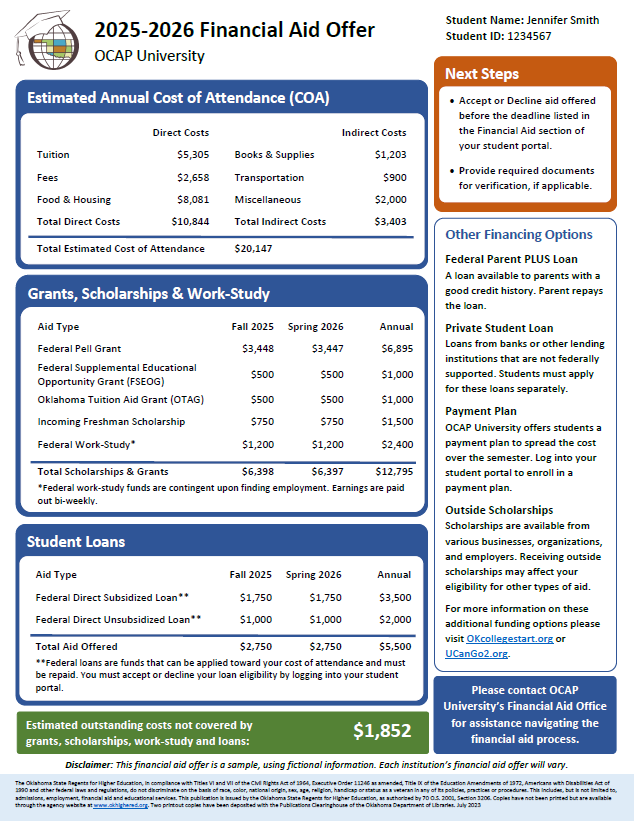

Let’s look at this sample financial aid offer from “OCAP University” as an example.

You’ll notice it lists:

- Estimated Annual Cost of Attendance (COA): tuition, fees, housing, meals, books, transportation, and other living expenses

- Grants, Scholarships, and Work-Study: money that does not need to be repaid

- Loans: borrowed funds that must be repaid with interest

- Estimated Remaining Cost: what’s left after all aid is applied

In this student’s example, the total cost of attendance is about $20,147. Her aid package covers most of it, leaving an estimated remaining cost of about $1,852.

Step 2: Understanding the Types of Aid

Here’s a quick breakdown:

- Grants: Need-based aid (like the Pell Grant) that you don’t have to repay.

- Scholarships: Merit-based (based on a student’s achievements, like grades, test scores, talents, or leadership) or criteria-based awards (based on specific traits or circumstances, like major, hometown, background, or interests) from schools, other organizations, or Red Kite.

- Work-Study: A part-time job (often on or near campus) that helps your student cover expenses.

- Loans: Money borrowed by students or parents that must be repaid, usually with interest.

Whenever possible, focus on grants and scholarships first, then work-study, and use loans only to fill any remaining gap.

Step 3: Compare Offers Carefully

Depending on the college, the mix of aid can look very different. That’s why it’s important to compare offers side by side, especially if your student has applied to multiple schools. One college may have higher tuition but offer more scholarships; another might look cheaper upfront but include more loans.

Ask yourself:

- What’s the total cost after grants and scholarships are applied?

- How much of the offer is loan-based aid (money that must be repaid)?

- Are there renewal conditions (like GPA, major, or credit-hour requirements)?

A simple spreadsheet or comparison chart can make these differences much clearer, and Red Kite’s parent planning resources can help you organize all of these details in one place.

Step 4: What if the Offer Doesn’t Cover Enough?

If you’re left with a gap (like in Jennifer’s case: $1,852), don’t panic. Parents still have several options:

- Appeal the offer: If your financial situation has changed (job loss, medical expenses, divorce, etc.), contact the financial aid office and request a reevaluation. Be ready to share documentation.

- Apply for additional scholarships: Many local, community-based, and private scholarships remain open throughout the year. Even a few smaller awards can add up and help close the gap.

- Explore payment plans: Most colleges offer monthly or term-based payment plans that spread costs out over time instead of one large lump sum.

- Consider Federal PLUS or private loans: If you still have a remaining gap, parent or private loans can help, but compare interest rates, fees, and repayment terms carefully before borrowing.

The Bottom Line

Submitting the FAFSA is only the first step. Understanding what comes next helps you make confident, informed decisions about your student’s future. Remember, a financial aid offer isn’t set in stone. With the right information and a bit of strategy you can make sure no aid opportunity goes untapped.

In this week’s Parent Resource Newsletter, we’ll walk you through how to read each section of a financial aid offer, compare multiple colleges side by side, and explore creative ways to cover any remaining gap. Parents, check your inboxes soon!